salt tax cap mortgage interest

The value of the SALT deduction as a percentage of adjusted gross income AGI tends to increase with a taxpayers income. The TCJA limited the mortgage interest deduction on high-value properties.

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Web The maximum SALT deduction is 10000 but there was no cap before 2018 You must itemize using Schedule A to claim the SALT deduction.

. Web 54 rows The Internal Revenue Service IRS has provided data on state and local taxes paid and deducted for tax year 2018 the first year the SALT cap went into effect. Starting with purchases after the TCJA was passed taxpayers can now only deduct interest on the first 750000 in principal compared to 1000000 under prior law. The Tax Cuts and Jobs Act TCJA capped it at 10000 per year consisting of property taxes plus state income or sales taxes but not both.

Web Using their 22 percent tax rate this deduction would reduce their 2021 income tax burden by 2200 calculated by multiplying. Web The cap made the tax code more progressive by broadening the tax base and it helped partially fund reductions in statutory tax rates. Most people do not qualify to itemize The state and local tax deduction commonly called the SALT deduction is a federal deduction that allows you to deduct the amount you pay in taxes to your state or.

Starting with the 2018 tax year the maximum SALT deduction available was 10000. Given the changes to the MID and SALT deductions in the TCJA. Web The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns.

Web When the trump TCJA ends in 2025 does that mean pending more failed democrat legislation that we can deduct unlimited SALT and deduct interest up to 1m not 750k or is it based on when you purchased your home. Web Mortgage interest subject to a limit of 1 million or 750000 depending on when you got the loan Medical or dental expenses if they make up 75 of your income Donations to charity. Since the SALT cap was put into place however very.

Repeal of the SALT deduction cap would be more regressive than the entirety of the TCJA and provide a 31000 tax cut for the top 1 percent of earners. The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. What counts Before the 2018 tax year homeowners getting a new mortgage were allowed to deduct interest paid on loans of up to 1 million secured by a principal residence or.

The SALT deduction cap was introduced as part of the Tax Cuts and Jobs Act as a means to broaden the individual income tax base and partially fund reductions in statutory tax rates. Web The TCJA also made it harder for homeowners to maximize the mortgage interest tax deduction by limiting the deduction for state and local income taxes SALT to 10000 when there was previously. Nita Lowey D-NY and Rep.

Web The mortgage interest tax deduction allows homeowners to deduct from their taxable income some or all of the interest they pay on a qualified home mortgage loan. Web Almost all 96 percent of the benef its of SALT cap repeal would go to the top quintile giving an average tax cut of 2640. Web The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

57 percent would benefit the top one percent a cut of 33100. Peter King R-NY introduced a bill in the House of Representatives to repeal the 10000 cap on the state and local deduction SALT. As a result the percentage of taxpayers claiming the deduction fell by nearly two-thirds while the average amount claimed fell by 80 percent.

Web For example if the higher SALT deduction reduces taxable income by 10000 and the marginal tax rate is 22 there will be 2200. The 10000 cap on the state and local SALT deduction was introduced as part of the Tax Cuts and Jobs Act as a means to broaden the individual income tax base and partially fund reductions in statutory tax rates. Web Housing Value Changes Under the SALT Cap.

Web However for tax years 2018 through 2025 the TCJA capped the SALT deduction at 10000 for single taxpayers and couples filing jointly limiting its value for tax filers. Web That means this tax year single filers and married couples filing jointly can deduct the interest on up to 750000 for a mortgage if single a joint filer or head of household while married taxpayers filing separately can deduct up to 375000 each.

Mortage Interest Deduction What Is The Mortgage Interest Deduction

How Some Taxpayers Are Using Pass Through Entity Taxes To Avoid The Salt Cap Limit The Compardo Wienstroer Conrad Janes Team

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Senators Menendez And Sanders Show The Way Forward On The Salt Cap Itep

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

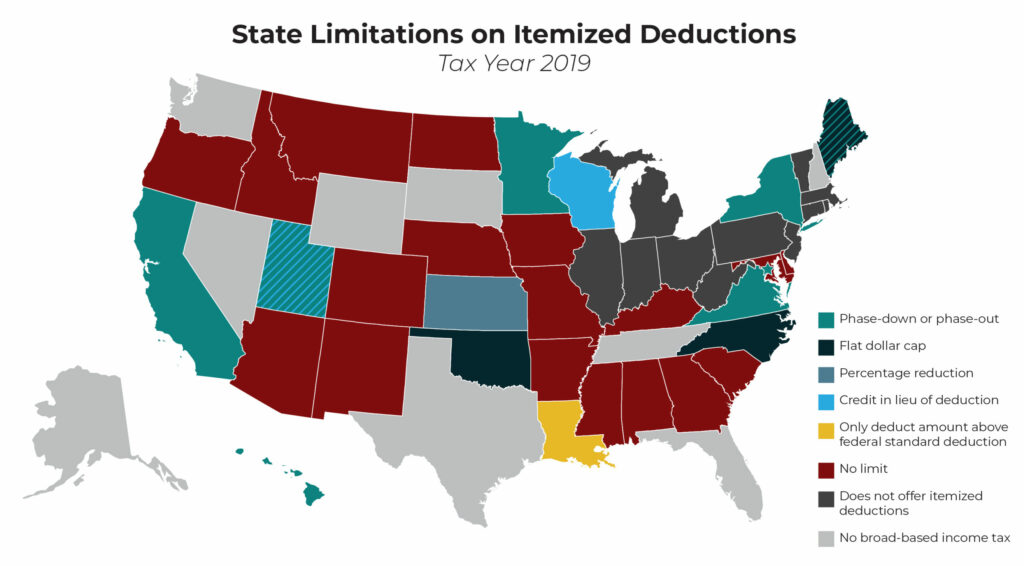

State Itemized Deductions Surveying The Landscape Exploring Reforms Itep

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

How Does The Deduction For State And Local Taxes Work Tax Policy Center

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

2021 Charitable Giving Strategies Signaturefd

State And Local Tax Salt Deduction Salt Deduction Taxedu

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center