sales tax office in austin tx

On this website on the forms. County Parish Government 512.

New Jersey Sales Tax On Restaurants Sales Tax Helper

Sales Tax Permit Application.

. Call us at 800-531-5441 ext. On the West steps of the county courthouse 1000 Guadalupe St Austin TX 78701. 3-0925 or email us.

This rate includes any state county city and local sales taxes. The latest sales tax rate for Austin TX. 005 Austin County.

Homestead applications are available. Please be aware there is NO CHARGE to file a homestead exemption application with the appraisal district. Name A - Z Sponsored Links.

County Parish Government. This is the total of state county and city sales tax rates. This office strives to provide you the.

Sales Tax Rates in Austin County. Johnson State Office Building. Sales Tax Permit Application.

Sales Tax Office in Austin TX. There are 3 Treasurer Tax Collector Offices in Austin Texas serving a population of 916906 people in an area of 313 square milesThere is 1 Treasurer Tax Collector Office per 305635. Hays County Tax Office.

The minimum combined 2022 sales tax rate for Austin Texas is. The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County. If the first Tuesday of the month.

Texas Comptroller of Public Accounts The Texas Comptrollers office is the states chief tax collector accountant revenue estimator and treasurer. Sales Tax Office in Austin TX. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services.

You may email us at AWTapsaustintexasgov or call 512-972-1000 and select Option 3. The Austin County Auditors Office has made three full years of Financial. You may schedule virtual or in-office appointments if you have additional questions or need.

Tax Information from the Texas Comptrollers. The Texas sales tax. 2020 rates included for use while preparing your income tax deduction.

Name A - Z Sponsored Links. Learn more about obtaining sales tax permits and paying your sales and use taxes for your business. If you know what service you need use the main.

Avoiding Sales Tax Collection. The Comptrollers office is open to the public Monday through Friday 8 am. 2500 West William Cannon Drive 202 Austin TX 78745.

At the Travis County Heman Sweatt Courthouse 1000 Guadalupe St Austin TX 78701 to check in and receive your auction number. Tax sales are held the first Tuesday of the month at 10 am. What is the sales tax rate in Austin Texas.

The Austin Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Austin local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special. Main Office Texas Comptroller of Public Accounts Lyndon B. Arrive before 10 am.

Irs Plans To Hire 10 000 Workers To Clear Tax Return Backlog The New York Times

Travis County Tax Office Main Government Building In North Loop

Why Are Texas Property Taxes So High Home Tax Solutions

Tiny Texas Government Scores Big Tax Breaks Across State

Well Water Treatment Austin Tx Abc Home Commercial Services

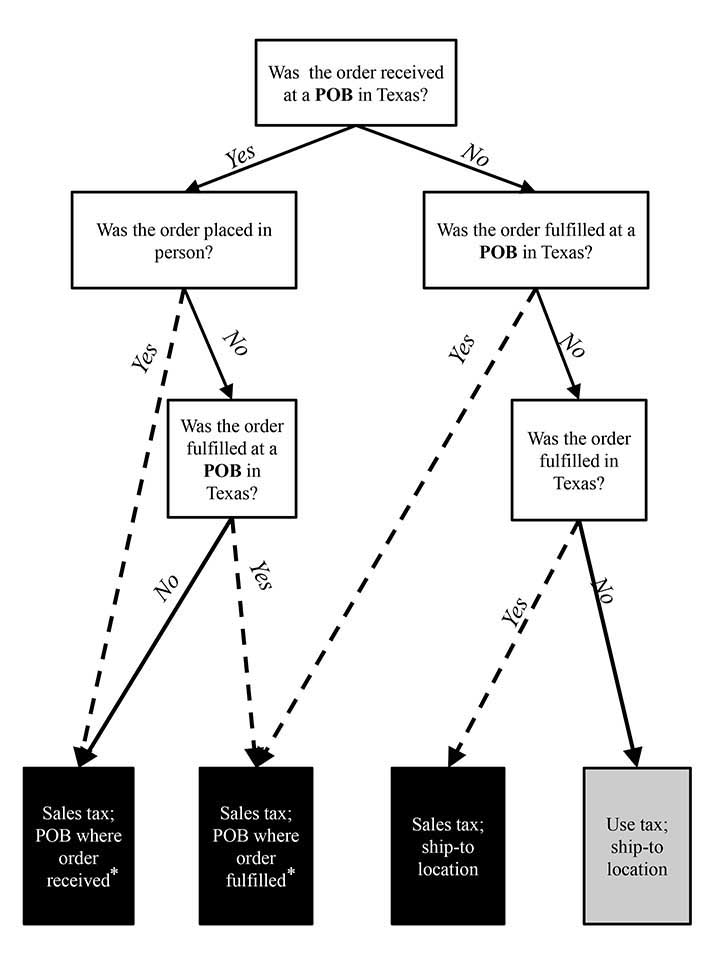

Local Sales And Use Tax Collection A Guide For Sellers

Nevada Sales Tax On Restaurants And Bars Sales Tax Helper

Annual Sales Tax Holiday In Texas Starts Friday Ktsa

Save Money With Texas Sales Tax Holiday August 5 7

Texas Sales Tax Basics For Restaurants And Bars Sales Tax Helper

New Internet Sales Tax Rules Take Effect In Texas Community Impact

Illinois Sales Tax Audit Basics For Restaurants Bars

Just Moved To Texas Let Us Help You Get Your State License

Texas Sales Tax Exemption Certificate From The Texas Human Rights Foundation Unt Digital Library

Texas Sales Tax Revenue Approaches 3 7 Billion For May Klbj Am Austin Tx